A highly informative guest lecture was conducted on 29.10.2024 in hybrid mode on the topic, “Input tax credit under GST in light of Safari Retreat Judgement.” The Resource Person for the session was Mr Ishan Bhatt, Associate Partner, Lakshmikumaran & Sridharan, Ahmedabad. The session provided valuable insights for tax honors students and members of the Center for Tax AND Public Finance (CTPF).

The lecture covered several important topics:

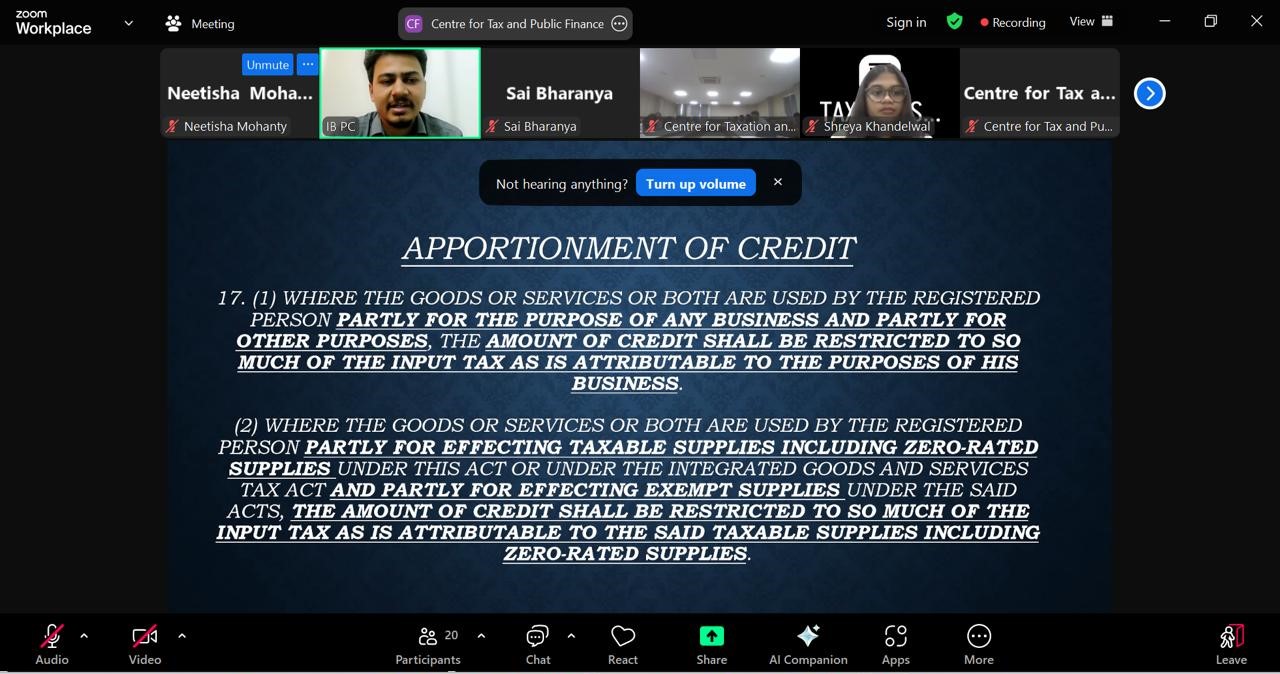

1. Core GST concepts including Input Tax Credit (ITC), apportionment of credit, and zero-rated supplies were explained in detail.

2. A thorough analysis of Section 16 and Section 17(5)(d) of the Central Goods and Services Tax (CGST) Act was presented, highlighting their significance in ITC claims.

3. Mr Ishan Bhatt discussed the recent Safari Retreats case, explaining the Orissa High Court’s decision and the subsequent Supreme Court ruling from early October 2024. This landmark judgment has significant implications for ITC on construction of immovable property.

4. The lecture concluded with an engaging Q&A session where participants explored the practical implications of these verdicts. Students also received guidance on important GST topics to focus on for upcoming internships and interviews.

This guest lecture provided an excellent learning opportunity for students specializing in taxation.